Everything you need to know about decision-making. Decision-making is an integral part of every manager’s job.

Decision-making has a wide-range, covering matters from selection of the venue for holding a meeting, to significant issues such as, assignment of resources, hiring and firing of personnel, rate of dividend, merger, etc.

Decision-making is not the monopoly of top management alone, though it is true that decisions made at this level are of far-reaching importance for the organization as a whole.

In fact, managers at all levels are engaged in decision-making of one kind or another, the significance of their decisions differing in proportion to the duties assigned and authority delegated to them.

The techniques of decision-making may be classified as:- 1. Non-Quantitative Techniques 2. Quantitative Techniques 3. Traditional Techniques 4. Modern Techniques.

A: Some of the non-quantitative techniques of decision-making are:- 1. Intuition 2. Experience 3. Experimentation 4. Brainstorming 5. Synectics.

B: Some of the quantitative techniques of decision-making are:- 1. Operations Research 2. Marginal Analysis 3. Correlation.

C: Three common traditional techniques for making programmed decisions are: (a) Habits (b) Operating Procedures (c) Organisation Structure. Traditional techniques used for making non-programmed decisions are:- (a) Judgment (b) Intuition (c) Creativity.

Modern Techniques for making Programmed Decisions are: (a) Break-Even Technique (b) Inventory Models (c) Linear Programming (d) Simulation (e) Probability Theory (f) Decision-Tree (g) Queuing Theory (h) Gaming Theory (i) Network Theory. Modern Techniques for making Non-Programmed Decisions include: (a) Creative Techniques (b) Participative Techniques (c) Heuristic Techniques.

D: The most commonly used decision making techniques are discussed: 1. Marginal Analysis 2. Cost Benefit Analysis 3. Risk Analysis 4. Linear Programming.

Techniques of Decision-Making – Used by Managers in Decision Making

Now-a-days, a number of techniques both quantitative and non-quantitative techniques are used by managers in making decisions. These techniques, if used properly, would contribute for the effectiveness of the decisions.

Some of the important techniques are discussed below:

1. Intuition:

It is an insight without logical backing where an individual does something without the aid of resoning process. A decision taken under this method is marked by convictions and inner feelings of the manger without the support of facts and figures. Under this method, quick decisions can be taken but there is no guarantee that it will a right decision.

2. Experience:

Adopting past decision to the present situation if the problem is of similar nature as that of one solved in the past. Of course, past experience gives a clear understanding of the issues involved in the present situation. But it is dangerous to give more weightage to the past experience because a decision applied in one situation may not be suitable to a different situation. Therefore, past experience can be used only to routine decisions.

3. Experimentation:

It involves practical application of each alternative in actual situation. The results are observed. The alternative give the best solution is selected. It is a time consuming and costly method. It leads to delay in decision making.

4. Brainstorming:

It was developed by A.F. Osborn. It involves the use of a small group. This group is simulated to creative thinking. A particular problem is placed before the group and members of the group are asked to provide solutions. Later all the solutions are critically evaluated to arrive at the best solution.

It helps the mangers to arrive at innovative solutions. The success of this technique lies in creating a free and open environment where members of the group participate without any inhibitions. The larger the number of solutions, the fairer is the chances in locating an acceptable solution. But it consumes lot of time and an expensive exercise. It emphasizes only quantity of solutions, which prove to be superficial.

5. Synectics:

Synectics is a concept developed by William J.J. Gordon. It is derived from a Greek word which means “Fitting together of diverse element”. A problem is presented to a group of people with different backgrounds and varied experiences. It is the responsibility of the group leader to present the problem and lead the discussion in order to stimulate creative solutions.

This approach ensures on the spot evaluation of ideas. The leader who is a technical expert assists the group in evaluating the feasibility of their ideas. When the problem is tough and challenging, this approach is used for effective decision-making.

Quantitative Techniques:

1. Operations Research:

The origin and development of operations research is attributed to military operations and applications during Second World War. Operations Research is the systematic method of studying the basic structure, functions and relationships of an organization as an open system. It aims at developing optimal solution with limited resources in a given situation. It employs optimizing models like Linear Programming, Project Management, Inventory Control, Simulation, Programmed Evaluation and Review Technique, Decision Theory and Waiting Line Theory.

2. Marginal Analysis:

It is a technique where there is a comparison of additional revenues with additional costs. The extra cost resulting from the addition of one more unit is compared with the benefit there from. Break even analysis is the modification of this technique wherein it tells the point of activity at which there will be no profit and no loss.

3. Correlation:

It is the study of degree of functional relationship between two or more variables. This method helps to make an estimate of one variable when the value of another variable is known. For example, when demand is known, profit can be determined.

Techniques of Decision-Making – Traditional and Modern Techniques

A wide range of techniques are available to enrich the decision-making process.

These can broadly be classified as:

1. Traditional Techniques

2. Modern Techniques

1. Traditional Techniques:

These techniques are divided into two groups:

I. Traditional techniques for making programmed decisions.

II. Traditional techniques for making non-programmed decisions.

I. Traditional Techniques for Making Programmed Decisions:

Three common traditional techniques for making programmed decisions are:

(a) Habits:

Habits are the ways in which problems are solved according to pre-defined notions. Managers do not apply scientific techniques to solve problems. By solving the same problem in a defined way over and over again, managers form the habit of solving it in that manner. It does not require much of managerial thinking and initiative.

(b) Operating Procedures:

Operating procedures are organisational habits. They guide decision-makers in solving organisational problems in a pre-defined manner. They are more formal than habits. However, they are flexible and can be changed. Cases of absence without leave are not left for managerial discretion. Standard procedures guide action in such cases.

(c) Organisation Structure:

It is a well-defined structure of authority-responsibility relationships. Each person knows his position in the organisation, his authority to make decisions, the extent to which it can be delegated to subordinates, the communication channel, the persons to whom he has to report etc. This helps in solving programmed problems.

II. Traditional Techniques for Making Non-Programmed Decisions:

Managers solve unstructured, novel and non-repetitive problems through judgment, intuition and creativity. No scientific basis of decision-making is followed. These are more of personal qualities than techniques for solving the problems. They, therefore, vary from person to person. Each manager perceives the problem in his own way and solves it to the best of his judgment. No scientific techniques are available to solve the problems.

2. Modern Techniques:

Modern techniques use mathematical models to solve business problems. They apply scientific and rational decision-making process to arrive at the optimum solution. They use quantifiable variables and establish relationships amongst them through mathematical equations and operations research techniques. They also make use of computers for data processing and storage to solve complex management problems.

These techniques can be classified as follows:

I. Modern Techniques for making Programmed Decisions:

These are as follows:

(a) Break-Even Technique:

It helps to determine that level of output at which total costs (variable costs and fixed costs) and total revenue are the same. Total profit at this volume of output called the break-even point is zero. It helps managers analyse the economic feasibility of a proposal. For any level of output, the amount of profit can be ascertained which serves as an acceptance or rejection criterion of the proposal. It is only a rough estimate of assessing a project since it assumes a constant selling price and fixed cost, which is not always so.

(b) Inventory Models:

So that business firms do not run out of stock, they carry enough inventory with them. Though this ensures regular supply of goods to customers, they incur costs to carry the inventory. These are the handling costs, storage costs, insurance costs, opportunity cost of money tied in the inventory etc. These are known as carrying costs. In order to reduce these costs, firms can keep minimum inventory in store and order for fresh inventory when the need arises. This will reduce the carrying cost of inventory but the ordering cost will go up.

These are the costs of placing an order and include cost of preparing an order and cost of receiving and inspecting the goods. Both the carrying and ordering costs operate in reverse direction. Increase in one means decrease in the other. Sophisticated inventory models are available for efficient management of inventory. They place order for goods at the point where the total of ordering costs and carrying costs is the least.

(c) Linear Programming:

It is a technique of resource allocation that aims to maximise output or minimise costs through optimum allocation of scarce resources. It is applied when resources are scarce and have to be optimally utilised so that output can be maximised out of limited resources. Linear programming is “a quantitative tool for planning how to allocate limited or scarce resources so that a single criterion or goal (often profits) is optimised.”

It aims to maximise profits or minimise costs by combining two variables which involve the best use of available resources. The (two) variables, the dependent and independent must be linearly related, i.e., increase or decrease in the independent variable should result in a corresponding increase or decrease in the dependent variable.

Linear programming is a managerial tool that helps in optimisation of resources. Its use is facilitated through mathematical equations.

(d) Simulation:

This technique is used to create artificial models of real life situations to study the impact of different variables on that situation. A model is prepared on the basis of empirical data, it is put to all kinds of influences, positive and negative, which may affect the project and the final results are the predictions of actual results if the project in question is put to use.

For example, if a transportation company wants to make a road or rail system, it will prepare a simulation model to analyse the effect of all the factors (e.g., traffic signals, fly overs, other heavy and light traffic commuting on the same road) and if this model appears to be feasible, actual construction of the rail/road system shall commence.

(e) Probability Theory:

Probability is the number of times an outcome shall appear when an experiment is repeated. What is the probability that sales will increase if expenditure on advertisement is increased is answered through probability theory. These decisions are based on past experience and some amount of quantifiable data.

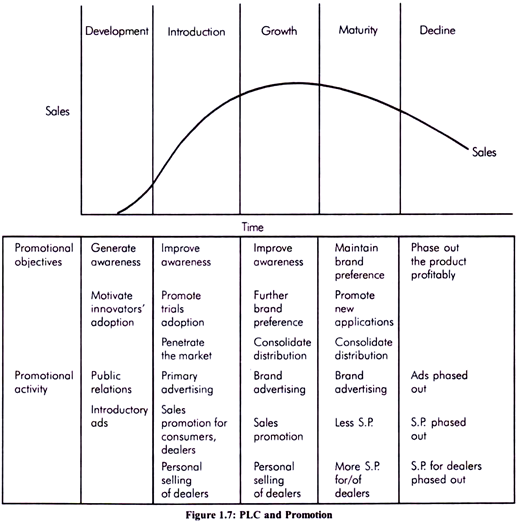

(f) Decision-Tree:

It is a diagrammatic representation of future events that will occur when decisions are made under different option plans. It reflects outcomes and risks associated with each outcome. Each outcome or future event is evaluated in terms of desired results and the outcome which gives the maximum value is selected out of alternative courses of action.

“Decision-trees depict, in the form of a ‘tree’, the decision points, chance events, and probabilities involved in various courses that might be undertaken”. For example, a firm wants to launch a new product which can be sold in the domestic market or the international market.

The probability chart for increase or decrease in sales in the national and international market is shown as follows:

The total value of sale in the national market is (50,000) (.60) + (10,000) (.40) = Rs.34, 000, and international market is (70,000) (.60) + (25,000) (.40) = Rs.52, 000. Since value of sale in international market is more than national market by Rs.18, 000, it is advantageous for the firm to launch its product in the international market.

The same can be diagrammatically depicted as follows:

(g) Queuing Theory:

This technique describes the features of queuing situations where service is provided to people or units waiting in a queue. When people or materials have to wait in queue (because of insufficient facilities), cost is involved in terms of loss of time and unutilised labour. Queuing theory is concerned with smooth flow of men and materials so that waiting time is reduced.

This involves additional cost also. Thus, a balance is maintained between the cost of queues and cost incurred to prevent the queues. Queuing models in software packages have made their application feasible. This theory is usually followed in banks and ticket counters. It helps in determining the number of counters so that customers have to wait for minimum time in queues.

(h) Gaming Theory:

This theory was developed by Von Neumann and Morgenstern. It helps business organisations face the competitors. If company X changes its plans; say reduces the price to increase the sales, it is likely that the competitors will do the same. How well is company X prepared to face this challenge and still continue with its changed plans is solved through games theory. It is, thus, a technique where two decision-makers maximise their welfare in the competitive environment. The decision-maker puts himself in his competitors’ shoes. If he were to compete against his own firm, what would he do based on his thinking, he plans a counter strategy.

(i) Network Theory:

The network techniques plan and control the time taken to accomplish a project. They involve breaking up of the project into smaller activities and finding out the time taken to accomplish each activity. If actual time taken to complete the project is more than the time determined, it calls for corrective action. PERT (Project Evaluation Review Technique) and CPM (Critical Path Method) are the important network techniques which help in planning and controlling the projects, in terms of time and cost.

II. Modern Techniques for making Non-Programmed Decisions:

The following techniques help in solving novel, non-routine and unstructured problems:

(a) Creative Techniques:

These techniques use creativity of managers to think of new ways of solving the problems. An important creativity technique is brainstorming where members of a group give all possible suggestions to generate alternative solutions to the problem. Together, these ideas help in formulating the most practical solution to the problem.

(b) Participative Techniques:

Employees and managers together arrive at the optimum decision. If those who make decisions and those who implement them jointly participate in the decision-making process, the quality of decisions will be better, there will be commitment to the implementation process and morale of employees will be high.

(c) Heuristic Techniques:

These techniques are based on trial and error approach to decision-making. Decision maker accepts that making strategic decisions in complex situations is not easy. There are role conflicts, information gaps and environmental uncertainties etc. which make decision-making difficult. Heuristic techniques help decision-makers proceed in a step wise manner to arrive at the rational decision to solve the non-programmed problems. These are basically computer aided techniques.

In this system, decision-making is supported by computers. Managers access information from the data processing system, retrieve the data relevant to their decision-making, test it for alternative solutions and accept the most appropriate solution. Managers keep on changing the variables in the form of inputs and analyse their impact on the desired output.

Regression analysis is one of the common computer based systems which helps in the decision-making process. The system is supportive to the ability of managers to take decisions through their judgment and creativity. An alternative to decision support system is the group decision support system where decisions are collectively taken in groups in meetings and seminars.

Techniques of Decision Making – Marginal Analysis, Cost Benefit Analysis, Risk Analysis and Linear Programming

Decision making, are not products of rationality. Irrational decisions based on intuition and judgment are quite common. Most of the time, decision makers cannot afford to wait till the time they get all the relevant facts and figures ready.

They have to take the call if they want to survive and flourish in a competitive environment. Several quantitative as well as qualitative factors impact the decision making process of managers.

The most commonly used decision making techniques are discussed below:

1. Marginal Analysis:

Since resources are scarce and we cannot have everything that we want, tough choices must be made. The concept of opportunity cost reminds us that every time we make a choice, something else must be given up. Economics provides us with a set of tools that can help us to make better choices.

Often times, the best decision is made by weighing the marginal benefits against the marginal costs. Why do economists insist that rational people made decisions at the margin? The explanation is simple the costs or benefits already incurred from doing some activity do not matter when you make future decisions.

Those past costs and benefits may influence what you think future costs of benefits, however, it’s the future costs and benefits that everyone bases decisions on.

You will compare the marginal benefits of additional study right now with the costs of more study. You will weigh the marginal benefits (maybe a better homework grade) against the marginal costs.

If the marginal benefits were greater than or equal to the marginal costs, you would continue reading. In fact, you’d continue reading until the marginal benefits are equal to the marginal costs. Any more reading after that would cause marginal costs to become greater than marginal benefits, and would be irrational.

2. Cost Benefit Analysis:

Cost Benefit Analysis or CBA is a relatively simple and widely used technique for deciding whether to make a change. As its name suggests, to use the technique simply add up the value of the benefits of a course of action, and subtract the costs associated with it.

Costs are either one-off, or may be ongoing. Benefits are most often received over time. We build this effect of time into our analysis by calculating a payback period. This is the time it takes for the benefits of a change to repay its costs. Many companies look for payback over a specified period of time – e.g. three years.

In its simple form, cost-benefit analysis is carried out using only financial costs and financial benefits. For example, a simple cost/benefit analysis of a road scheme would measure the cost of building the road, and subtract this from the economic benefit of improving transport links.

It would not measure either the cost of environmental damage or the benefit of quicker and easier travel to work. A more sophisticated approach to cost/benefit measurement models is to try to put a financial value on intangible costs and benefits.

This can be highly subjective – is, for example, a historic water meadow worth $25,000, or is it worth $500,000 because if its environmental importance? What is the value of stress-free travel to work in the morning? These are all questions that people have to answer, and answers that people have to defend.

3. Risk Analysis:

Almost everything we do in today’s business world involves a risk of some kind- customer habits change, new competitors appear, and factors outside your control could delay your project. But formal risk analysis and risk management can help you to assess these risks and decide what actions to take to minimize disruptions to your plans.

They will also help you to decide whether the strategies you could use to control risk are cost-effective. Here we define risk as ‘the perceived extent of possible loss’. Different people will have different views of the impact of a particular risk – what may be a small risk for one person may destroy the livelihood of someone else.

One way of putting figures to risk is to calculate a value for it as:

Risk = probability of event x cost of event

Doing this allows you to compare risks objectively. We use this approach formally in decision making with Decision Trees Risk analysis allows you to examine the risks that you or your organization face. It is based on a structured approach to thinking through threats, followed by an evaluation of the probability and cost of events occurring.

Risk analysis forms the basis for risk management and crisis prevention. Here the emphasis is on cost effectiveness. Risk management involves adapting the use of existing resources, contingency planning and good use of new resources.

To carry out a risk analysis, follow these steps:

Identify Threats:

The first stage of a risk analysis is to identify threats facing you.

Threats may be:

(a) Human – from individuals or organizations, illness, death, etc.

(b) Operational – from disruption to supplies and operations, loss of access to essential assets, failures in distribution, etc.

(c) Reputational – from loss of business partner or employee confidence, or damage to reputation in the market.

(d) Procedural – from failures of accountability, internal systems and controls, organization, fraud, etc.

(e) Project- risks of cost over-runs, jobs taking too long, of insufficient product or service quality, etc.

(f) Financial – from business failure, stock market, interest rates, unemployment, etc.

(g) Technical – from advances in technology, technical failure, etc.

(h) Natural – threats from weather, natural disaster, accident, disease, etc.

(i) Political – from changes in tax regimes, public opinion, government policy, foreign influence, etc.

This analysis of threat is important because it is so easy to overlook important threats. One way of trying to capture them all is to use a number of different approaches- Firstly, run through a list such as the one above, to see if any apply.

Secondly, think through the systems, organizations or structures you operate, and analyze risks to any part of those. See if you can see any vulnerabilities within these systems or structures. Ask other people, who might have different perspectives.

A. Estimate Risk:

Once you have identified the threats you face, the next step is to work out the likelihood of the threat being realized and to assess its impact. One approach to this is to make your best estimate of the probability of the event occurring, and to multiply this by the amount it will cost you to set things right if it happens. This gives you a value for the risk.

B. Manage Risk:

Once you have worked out the value of risks you face, you can start to look at ways of managing them. When you are doing this, it is important to choose cost effective approaches – in most cases, there is no point in spending more to eliminating a risk than the cost of the event if it occurs. Often, it may be better to accept the risk than to use excessive resources to eliminate it.

Risk may be managed in a number of ways:

(a) By Using Existing Assets:

Here existing resources can be used to counter risk. This may involve improvements to existing methods and systems, changes in responsibilities, improvements to accountability and internal controls, etc.

(b) By Contingency Planning:

You may decide to accept a risk, but choose to develop a plan to minimize its effects if it happens. A good contingency plan will allow you to take action immediately, with the minimum of project control if you find yourself in a crisis management situation. Contingency plans also form a key part of Business Continuity Planning (BCP) or Business Continuity Management (BCM).

(c) By Investing in New Resources:

Your risk analysis should give you the basis for deciding whether to bring in additional resources to counter the risk. This can also include insuring the risk- Here you pay someone else to carry part of the risk – this is particularly important where the risk is so great as to threaten your or your organization’s solvency.

C. Review:

Once you have carried out a risk analysis and management exercise, it may be worth carrying out regular reviews. These might involve formal reviews of the risk analysis, or may involve testing systems and plans appropriately.

4. Linear Programming:

It is a technique of allocating scarce resources in order to maximize gains. It is a mathematical tool for determining a way to achieve the best outcome such as maximum profit or lowest cost.

It is used in computer modelling (simulation) to find best possible solution in allocating limited resources such as energy, machines, materials, money, personnel, space, time etc. to achieve maximum profit or minimum cost.

However it is applicable only where all relationships are linear and can accommodate only a limited class of cost functions. A relationship of direct proportionality that, when plotted on a graph, traces a straight line.

In linear relationships, any given change in independent variable will always produce a corresponding change in the dependent variable. For example, a linear relationship between production hours and output in a factory means that a 10 per cent increase or decrease in hours will result in a 10 per cent increase or decrease in the output.

Techniques of Decision-Making – For Programmed and Non-Programmed Decisions

Basic decision types can be divided into programmed and non-programmed decisions. Decisions are programmed to the extent that they are repetitive and routine, to the extent that a definite procedure has been worked out for handling them so that they don’t have to be treated de novo each time they occur.

Decisions are non- programmed to the extent that they are novel, unstructured, and consequential. There is no cut and dried method for handling the problem because it hasn’t arisen before, or because it’s precise nature and structure are complex, or because it is so important that it deserves a subjective treatment.

The techniques of decision making for both programmed and non-programmed decisions, range from the very simple to the rather sophisticated. Which technique you choose for a given decision will be influenced by the importance and complexity of the decision. The following discussion pertains to the easy and practical techniques that can be applied to simple or complex decisions.

I. Traditional Techniques for Programmed Decisions-Habit:

An individual acquires many habits (here we are concerned with the work habits only) over a period of time. They are influenced by his past experience and learning, like generally people tend to acquire the work habits of their first boss when they start their career. For example- a manager may be in a habit of always keeping the past records upto a period of last 10 years.

Standard Operating Procedures:

In almost all the organizations standard procedures got developed to perform the routine tasks. For example- it may be a standard practice in an organization to mark the name of the person and computer file on any paper typed by a computer operator. These procedures are followed as a matter of habit in routine in organizations.

Organization structure:

In a well-defined organization structure, every job position has a well laid out job profile, well drawn lines of responsibility and authority, proper communication channels and clarity with regard to goals and sub-goals to be achieved. When goals are clear, the responsibility for decision is fixed, and the decision maker knows with whom to communicate, the structure in itself facilitate decision-making.

II. Modern Techniques for Making Programmed Decisions:

Modern techniques of decision making involves formulating mathematical problems and finding their optimal solutions by using the operations research techniques. Operations research is a term coined during World War II to describe analysis of the effectiveness of various alternative plans, strategies, technologies and techniques of wartime operations against the enemy. Subsequent to WWII the techniques are applied to many civilian as well as military activities.

Operations Research (OR) deals with:

1. Building mathematical models of decision-making processes,

2. Development of mathematical techniques and algorithms for processing the models,

3. Applications of the resulting techniques and algorithms in various disciplines including Finance and Management.

Few of the operations research techniques commonly used in decision making are discussed below:

1. Linear Programming:

It is a resource allocation technique. Whenever we have a problem of limited resources, which we want to use optimally, a linear programming model helps in evaluating the alternative resource combinations giving different outputs. However, for the application of this model, there must be a linear relationship between variables.

This means that a change in one variable is accompanied by a proportional change in the other variable. For example- if a company has to decide the shipping route of its ship which entails the minimum costs, the distance and cost of shipping are linear variables – any change in distance will directly affect the costs.

2. Queuing Theory:

Whenever a decision involves balancing the cost of a waiting line against the cost of service to maintain that line, it can be made easier with queuing theory. This includes such common situations as determining how many gas pumps are needed at gas stations, tellers at bank windows, or check-in lines at airlines ticket counters. In each situation management wants to minimize cost by having as few stations as possible, yet not so few as to test the patience of the customers.

3. Game Theory:

Game Theory is a mathematical theory that deals with the general features of competitive situations in a formal abstract way. It places particular emphasis on the decision-making process of the adversaries. It leads to assume how a competitor would react to your own strategy. It is like placing strategies and counter strategies on behalf of one’s own organization and its adversary so that an ultimately winning strategy can be decided.

4. Probability Theory:

With the help of probability theory, managers can use statistics to reduce the amount of risk in plans. By analyzing the past patterns, a manager can improve current and future decisions.

5. Simulation:

Simulation is the model of a real life situation. Suppose, Raman wants to open a hospital, he would simulate everything he perceives to be in that – number of rooms, number of doctors, facilities, charging pattern, and so on. Now he wants to see whether he should go for a physiotherapy center along with the hospital or not.

He would include the variable of physiotherapy center in his model, and see its impact. Now he can compare future scenario of a hospital with a physiotherapy center and without a physiotherapy center. The technique has given him a solid ground for taking this decision. Likewise simulation is used to see the effect of change in different variables in a given set of circumstances.

6. Network Techniques:

There are two popular network techniques- CPM- critical path methods, and PERT-program evaluation review technique. These techniques are used to manage projects. The idea is to sequence the activities to be performed in such a way so that the overall time taken in the completion of the project is minimum. Since time is money, completing the project in the minimum possible time increase the returns on the project by manifolds.

III. Traditional Techniques for Making Non-Programmed Decisions – Judgment, Intuition and Creativity:

The decision maker is supposed to possess good deal of creativity and should be able to balance his intuition and given facts to reach a final judgment. These are personal traits rather than techniques. People consider how various decision alternatives fit with their personal standards as well as their personal goals and plans. The best decision for someone might not be best for someone else.

Rules of Thumb:

At times some rules are established which make basis for even non programmed decisions. Like -‘our pricing policy should not be reactive to the competitors pricing policy. We would price on the basis of costs only.’ These kinds of rules of thumb decides direction to future strategies.

IV. Modern Techniques for Non-Programmed Decisions – Creative Techniques:

These techniques use creativity of individuals to generate different alternatives to solve the given problems. For example- brainstorming is one of the most creative techniques that encourage individuals to think creatively without any limiting constraints. In this way, non-conventional ideas and decisions can be reached.

a. Participative Techniques:

Modern era has brought with it the concept of employee participation in the decision making process. The participation of implementation team in the decision process improves the decision process as the information on which decision is based include ground realities also.

b. Heuristic Techniques:

People often attempt to simplify the complex decisions they face by using heuristics- simple rules of thumb that guide them through the complex array of decision alternatives. There are mainly two types of heuristics- availability heuristics and representative heuristics. The availability heuristic is the tendency for people to base their judgment on information that is readily available to them – even though it might not be accurate.

The representative heuristic is the tendency to perceive others in stereotypical ways if they appear to be typical representative of the category to which they belong. For example- suppose you believe that accountants are bright and mild mannered persons, you may identify one if you meet someone like this in a party.

These techniques can be quite useful. For example- financial planners rely on heuristics when deciding how to compose investment portfolios.

Note that this categorization of techniques is an abstract categorized made for the purpose of easy understanding. The only difference is that some techniques were being used traditionally, and some techniques emerged later in the times when computers made it easy to process vast amount of mathematical data. As such decision techniques discussed under the heading – ‘modern techniques for programmed decisions’ may be used for non-programmed decisions also.

Techniques of Decision-Making – Qualitative and Quantitative Techniques

The following are some of the important decision-making techniques:

1. Qualitative Techniques

2. Quantitative Techniques

1. Qualitative Decision-Making Techniques:

There is a great importance of generating a reasonable number of alternatives, so that one can decide upon the better quality items and make better decision.

Generating a reasonable number of alternatives is very useful for solving any complex problem.

There are following means of generating the alternatives:

(a) Brainstorming,

(b) Synectics, and

(c) Nominal Grouping.

(a) Brainstorming:

This technique was developed by Alex F. Osborn, and is one of the oldest and best known techniques for stimulating the creative thinking. This is carried out in a group where members are presented with a problem and are asked to develop as many as potential solutions as possible.

The member of the group may be experts, may be from other organizations but the members should be around six to eight. The duration of the session may be around 30 minutes to 55 minutes. The premise of brainstorming is that when people interact in a free and exhibited atmosphere, they will generate creative ideas. The idea generated by one person acts as a stimulus for generating idea by others.

This generation of ideas is a contagious and creates an atmosphere of free discussion and spontaneous thinking. The major objective of this exercise is to produce as many deals as possible, so that there is greater likelihood of identifying a best solution.

The important rules of brainstorming are as given below:

(i) Criticism is prohibited.

(ii) Freewheeling is always welcome.

(iii) Quantity is desirable.

(iv) Combination and improvements are sought.

One session of brainstorming exercise generates around 50 to 150 ideas. Brainstorming is very useful in research, advertising, management, armed forces, governmental and non-governmental agencies.

The limitations of brainstorming are given below:

(i) It is not very effective when a problem is very complex and vague.

(ii) It is time-consuming.

(iii) It is very costly.

(iv) It produces superficial solutions.

(b) Synectics:

This technique was developed by William J.J. Gordon. It is recently formalized tool of creative thinking. The word Synectics is a Greek word, meaning the fitting together of diverse elements. The basic purpose of synectics is to stimulate novel and even bizarre alternatives through the joining together of distinct and apparently irrelevant ideas.

The selection of members to synectics group is based on their background and training. The experienced leader states the problem for the group to consider, group reacts to the problem stated on the basis of their understanding and convictions. When the nature of the problem is thoroughly reviewed and analyzed, group proceeds to offer potential solutions.

The leader has to structure the problem and he/she can use various methods to involve the preconscious mind, like role-playing, use of analogies, paradoxes, metaphors and other thought provoking exercises. This helps in generation of alternatives. The technical expert assists the group in evaluating the feasibility of ideas. It also suffers from some limitations of brainstorming. This is more useful and appropriate for solving complex and technical problems.

(c) Nominal Grouping:

This was developed by Andre Dellbecq and Andrew Van de Ven. Nominal group is very effective in situations where a high degree of innovation and idea generation is required.

It is highly structured and follows following stages:

Stage-1:

Around seven to ten participants with different background and training are selected, familiarized with a selected problem like what alternatives are available for achieving a set of objective.

Stage-2:

Each member is asked to prepare a list of ideas in response to the identified problem, individually for achieving a set of objective.

Stage-3:

After ten minutes, the member shares ideas, one at a time, in a round-robin manner. The group facilitator records the ideas on a blackboard or flip chart for all to see.

Stage-4:

Each group member then openly discusses and evaluates each recorded ideas. At this point, it may be rewarded, combined, added or deleted.

Stage-5:

Each member votes ranking the ideas privately. Following a brief discussion of the vote, a final secret ballot is conducted. The group’s preference is the arithmetical outcome of the individual voter, these are followed by concluding meeting.

2. Quantitative Techniques:

There are a number of quantitative techniques for decision-making that are discussed below:

(a) Stochastic Methods:

In many management decisions, the probability of the occurrence of an event can be assumed to be known, even when a particular outcome is unpredictable. Under these conditions of risk, stochastic methods will be useful. Actually, stochastic methods merely systematize the thinking about assumptions, facts and goals that is involved in decisions under conditions of risk.

Three steps are basic to formalizing the factors to be considered in a decision involving probabilities:

(i) The decision-maker should first lay out, in tabular form, all the possible actions that seem reasonable to consider and all the possible outcomes of these actions.

(ii) The decision-maker must then state in quantitative form a probability distribution, projecting chances of each outcome that might result from each act. In this step, it may only be possible to assign probabilities that are reasonable estimates. The key to this step is to state explicitly the various probabilities that might be attached to each act-outcome situation.

(iii) Finally, the decision-maker must use some quantitative yardstick of value (usually rupees) that measures the value of each outcome. It is then possible to calculate an average of the outcome-values weighted by the assigned probabilities; the result is called the expected monetary value.

To illustrate the use of these steps, suppose that a Store Manager of Ramson Limited must decide whether to stock Brand A or Brand B. Either brand can be stocked but not both. If A is stocked and it is a success. The manager can make Rs.200/-, but if it is a failure, there can be a loss of Rs.500/-. If Brand B is stocked and it is a success, the manager can make Rs.400/ -, but if it is a failure, there can be a loss of Rs.300/-.

Which brand should be stocked? Without some idea of the probabilities of success and failure of these brands, the manager’s thinking cannot be quantified. But assume that the manager’s feelings about the probabilities of each outcome are shown in Table 9.1.

(b) Payoff Table:

The Store Manager can present the above information in tabular form, showing the conditional values for each strategy (choice of brand) under each state of nature (the combination of uncontrollable factors, such as demand, that determine success or failure). The simplest payoff table as the first step in stating strategies and possible outcomes is shown in Table 9.2.

With the information in Table 9.1 the Store Manager can use subjective estimates of risks assumed above and multiply the conditional values by their probability of occurrence. This calculation will result in expected values. Table 9.2 shows the expected value pay off, using the assumed payoff in Table 9.1 and the above feelings about the probability of success for Brands A and B.

From the expected value payoff Table 9.3, the store manager can determine the total expected value for each strategy by obtaining the sum of the expected values for each state of nature. If Brand A is stocked, the total expected value is Rs.60/- (Rs.160-100); if Brand B is stocked, the total expected value is Rs.50/- (Rs.200-150); therefore, under the assumptions in this case, the store manager would decide to stock Brand A, because its total expected value is Rs.10/- more than if Brand B were stocked. Obviously, if the total expected value for stocking each brand had been negative, the manager would decide not to stock either, because there would probably be a loss under either strategy.

(c) Simulation Techniques:

Often, when a management problem is too complex to be answered by series of mathematical equations, it is possible to simulate the probable outcomes before taking action. In this way, the manager may rapidly try out on paper (or with a computer) the results of proposed actions before the actions are taken. By trying out several policies, it is possible to determine which one has the best chance of providing the optimum result.

The idea of randomness represented by random numbers is at the heart of simulation. Random numbers are numbers, each of which has the same chance of being selected. Tables of random numbers are now readily available.

One type of simulation is used in queuing problems, one in which the need for personnel or equipment varies over a time period but the determination of the peak demands cannot be estimated because the occurrence is random or due to chance. With simulation, the manager can try out available strategies as they might result in different outcomes, depending upon probabilities from a table of random numbers. For example, the store manager may wish to determine the work schedules for three sales people to serve customers and to decide whether to add a fourth salesperson.

The problem arises from not knowing when customers may appear in the store. Experience may indicate the probabilities that at some hours of the day all three sales people will be serving customers, but that at other times the sales people will be idle.

In simulating the traffic for a day, the manager may wish to use subjective probabilities for those times in which there are no data from experience, but even if there are no experience data, it is still possible to simulate an activity by using random numbers.

In practice, simulation is carried out by electronic computers. In seconds, a computer can perform thousands of simulation trails and at the same time compile all costs. At the present time, inventory decision rules are commonly tested on computers.

The executive specifies such things as reorder points and order quantity and the computer determines the costs of that policy over the same period of time. After many different policies are put through the series of simulation runs, the best policy can be selected.

(d) Breakeven Analysis:

The simplest approach for showing the relationship of revenue to cost is the breakeven chart.

Revenue and cost can be studied by directing attention to:

(i) Total revenue and total cost,

(ii) Average revenue and average cost per unit of output, and

(iii) Changes in revenue and cost.

Breakeven analysis directs attention to the first of these. Breakeven analysis implies that at some point in the operations total revenue equals total cost-the breakeven point. This analysis can be handled algebraically or graphically; however, in all cases, the first step is to classify costs into at least two types-fixed and variable.

The distinction between total fixed and total variable costs stresses that only variable costs will increase with an increase in the production rate of output. However, it should be clear that when average cost per unit is considered, fixed cost per unit of output will decline as volume increases- the constant fixed costs are spread over more units of output.

Variable costs per unit of output may increase proportionally with an increase in output, or they may decrease per unit of output (for example, if quantity discounts are significant), or they may increase per unit of output (if the quantity of materials is very short and thus price increases as output increases).

In most industries, variable costs per unit can reasonably be assumed to be constant, and thus total variable costs will appear as a straight line (linear) when plotted against various quantities of output. The cost-volume-profit relationship can best be visualized by charting the variables. A breakeven chart is graphical representation of the relationship between costs and revenue at a given time.

The simplest breakeven chart makes use of straight lines that represent revenue, variable costs, and total costs. The construction of this chart requires only that the cost and revenue be known at two points (volumes of output), because only two points are required to draw a straight line.

The point at the Y intercept (left-hand side of chart) is given by definition – Revenue line will start at zero volume; variable costs also will start at zero volume; fixed costs will be given level on the Y axis because, by definition, they would continue even if there were no production.

Cost and revenue data at an actual volume level provide the basis for the necessary second point. All other points on the lines are the results of the assumption of linear relationships for both revenue and costs.

Techniques of Decision-Making – Traditional and Modern Techniques

Decision-making has become a complex problem. A number of techniques are available which help in taking decisions. The nature and significance of decision will determine the type of technique to be used. The selection of appropriate technique depends upon the judgment of decision maker. The decision making techniques can be classified into traditional and modern.

These are discussed as follows:

Traditional Techniques of Decision-Making:

The decisions can be classified into programmed decisions and non-programmed decisions. Both the classifications have different decision-making techniques.

A. Decision-Making for Programmed Decisions:

Following techniques are used for taking programmed decisions:

(a) Standard Procedures and Rules:

Every organisation develops standard procedures and rules for taking routine and repetitive decisions. Whenever needed, a manager refers to the standard procedures and rules before taking simple decisions. An effort is made to have consistency in routine decisions. Routine decisions do not require application of special skill and knowledge so such decisions can be taken without much difficulty.

(b) Organisational Structure:

A relationship is established between a superior and a subordinate. This relationship comes out of organisational structure. Persons at different organisational structures are assigned work to be done by them. For taking up this work, managers need authority to take decisions. The authority to take decisions needs proper information back up. All managers or decision making centres are linked to information system for supplying information when needed.

B. Decision-Making for Non-programmed Decisions:

Non-programmed decisions are strategic in nature and require separate analysis and interpretation. The quantitative and scientific techniques help in taking such complex and unique problems. A manager does not entirely depend upon his knowledge, ability and judgment but these skills are associated with scientific methods for achieving good results. The use of quantitative techniques ensures high degree of precision and accuracy.

Some of these techniques are explained below:

(i) Linear Programing:

This technique is used to determine the best use of limited resources for achieving a given objective. It is based on the assumption that there exists a linear relationship between variables and the limits of variations could be ascertained. It is particularly helpful where input data can be quantified and objectives are subject to definite measurement. Linear programming is applicable in such problem areas as – production planning, transportation, warehouse location and utilisation of production and warehouse facilities at an overall minimum cost.

(ii) Probability Theory:

This statistical tool is based on the assumption that certain things are likely to happen in future in a manner which can be predicted to some extent by assigning various probabilities. In this technique pay-off matrices and decision trees are constructed to represent variables. The decision tree is an extension of pay-off matrices and helps the managers in assigning financial results to various available recourses of action, modifying these result probabilities and comparing them for selecting an appropriate course of action.

(iii) Game Theory:

Game theory helps in making decisions under competitive situations. It was basically developed for use in wars so that actions of the army can be decided in the light of actions taken by opposite army.

The term ‘game’ represents a conflict between two or more parties. The game is described by set rules. These rules clearly specify what each person, called player, is required to do under all possible set of circumstances. A person has to consider a rational course of action by not only by considering his actions but also by considering the actions of other persons. All players act intelligently and rationally and are well informed about the decision situation except the opponent’s actions in a particular period. For each player the outcome may represent a gain or loss or a draw.

(iv) Queing Theory:

It is also known as ‘waiting line theory’ to be applied for maintaining a balance between the cost of waiting line and cost of preventing the waiting line in respect of utilisation of personnel, equipment and services. In waiting line situations, problems arise because of either too much demand on the facilities, in which case we may say that there is an excess of waiting time or that there are not enough service facilities or too little demand in which case there is either too much idle facility time or too many facilities.

An effort is made to obtain balance between the costs associated with waiting time and idle time and queing theory helps in achieving this balance. This theory helps in arriving at a decision about the provision of optimum facilities. It should be noted that this theory does not directly solve the problem of minimising the total waiting and service costs but it provides the management with information necessary to take relevant decisions for the purpose.

(v) Network Techniques:

Network technique is used for preparing and controlling the project activities. Project Evaluation and Review Technique (PERT) and Critical Path Method (CPM) are used for planning, monitoring and implementing time bound projects. These techniques help managers in deciding the logical sequence in which various activities will be performed. By applying these techniques large and complex projects can be executive within the stipulated time and cost.

Modern Techniques of Decision-Making:

Modern business is facing drastic changes in working. The decision-making is becoming more and more complex these days. The changing and challenging business environment requires special attention for decision making process.

Some techniques followed at present are discussed as follows:

(i) Heuristic Techniques:

This technique is based on the assumption that in a complex and changing business situation strategic problems cannot be solved by applying rational and scientific techniques. In an uncertain environment and conflicting interests the problem will have to be fragmented into small components for taking a realistic view. By splitting the problem into small parts and analysing each part separately, a decision can be reached. It is a trial and error method based on rules of thumb.

Heuristic techniques are developed by managers to deal with various components at different stages. Computers can easily be used for solving complex and strategic problems. This technique is a more refined way of trial and error method because it is developed by applying analytical and creative approach.

(ii) Participative Decision-Making:

It is method of applying democratic means for decision making process. In traditional managerial techniques, decisions are taken at top levels of management and these are intimated to lower levels for implementation. In participative decision-making, employees at various levels are involved in making various decisions.

When subordinates are made a part of decision making, it not only helps in getting the advantage of their practical experience but also helps in implementing decisions properly. The subordinate staff feels motivated and encouraged and takes active interest in the working.